Irs pay estimated taxes online 2021

The best way to make a payment is through IRS Online Account. View 5 years of payment history including your estimated tax payments.

How To Pay Your Taxes With A Credit Card In 2022 Forbes Advisor

Those are not sent to the IRS when you filed.

. 100 of the taxes shown on your 2021 Tax Return. Both individuals and business owners may pay federal taxes using EFTPS whereas Direct Pay is only available to individuals. You cant pay your 2021 taxes online until after this date.

Do not mail Forms 540-ES to us. They can also visit IRSgovpayments to pay electronically. While you can make payments online you can also mail them in to avoid late fees.

In addition there is no limit to the amount of money that can be sent via EFTPS unlike Direct Pay which caps at. Ad Take advantage of current tax programs before its too late. If your situation changed in 2022 and you will not owe more than 1000 on the 2022 return then estimates are not required at all.

Tom Wolf Governor C. - For 1st Quarter. No later than June 15 2021 - For 3rd Quarter.

How do I pay my 2021 estimated taxes online. Ad Use Our Free Powerful Software to Estimate Your Taxes. Personal Income Tax Payment.

Make and View Payments. The partners report the information from the K-1 or K-3 on their own returns and pay any taxes due including estimated taxes. How to pay estimated taxes.

1040 1040A 1040EZ Tax Period for Payment. No later than April 15 2021 - For 2nd Quarter. 100 of the tax shown on your 2021 return.

Estimates were produced only because you owed more than 1000 on the 2021 return and are OPTIONAL to pay. The deadline to file and pay your 2021 estimated taxes has passed. If you dont pay your taxes by then you will need to make them in person or by mail.

Select the blue button. The final two deadlines for paying 2021 estimated payments are September 15 2021 and January 15 2022. Realty Transfer Tax Payment.

Make a Payment Reason for Payment. Any payment received after the. Estimated Tax Apply Payment To.

To determine if these changes will affect your 2021 estimated tax payments see Estimated tax law changesIf you need to adjust already-scheduled payments due to the new brackets and rates you may cancel and. This includes self-employment tax and the alternative minimum tax. Aside from income tax taxpayers can pay other taxes through estimated tax payments.

Enter Your Tax Information. Small Business Payment Type options include. State taxes for.

Payment for Unpaid Income Tax. There taxpayers can see their payment history any pending payments and other. Make a payment from your bank account or by debitcredit card.

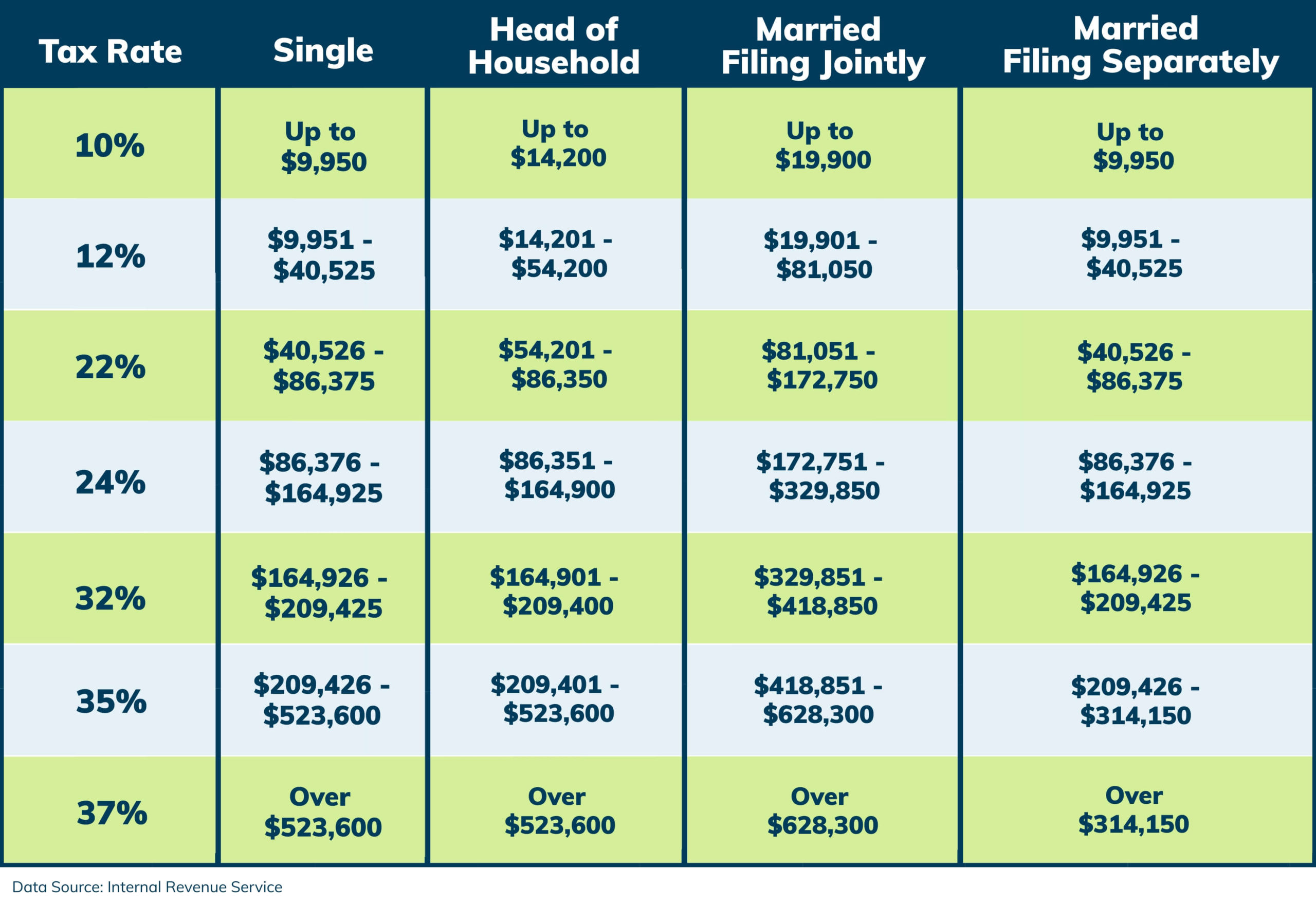

90 of the expected taxes of your 2022 Tax Return or. The last day to pay is June 15th. The 2021-2022 New York State budget replaced the highest personal income tax bracket and rate for 2021 with three new brackets and rates.

Log in and select Make an Estimated Payment See the instructions for Form 760 760PY or 763 for more on computing your estimated tax liability. Payment for tax due on the 2021 MI-1040 Payment in response to a 2021 Proposed Tax Due letter sent to you by the Michigan Department of Treasury Michigan Estimated Income Tax for Individuals MI-1040ES Select the payment type 2022 Estimate. See What Credits and Deductions Apply to You.

Web Pay Make a payment online or schedule a future payment up to one year in advance go to ftbcagovpay for more information. How Partners Pay Estimated Tax. Scheduling tax payments for 2020 and 2021 was a breeze.

Taxpayers can check out these forms for details on how to figure their payments. Electronic Funds Withdrawal EFW Individuals can make an extension or estimated tax payment using tax. In other words you can use your exact figure from your previous year return or you can estimate within 10 of your anticipated 2022 tax.

Individual Payment Type options include. We can help protect your assets and negotiate a settlement. You can also make a guest payment without logging in.

An estimated payment worksheet is available through your individual online services account to help you determine your estimated tax liability and how many payments you should make. You wont owe an estimated tax penalty if the tax shown on your 2022 return minus your 2022 withholding is less than 1000. The final quarterly payment is due January 18 2022.

Form 1040-ES Estimated Tax for Individuals includes instructions to help taxpayers figure their estimated taxes. How To Pay Estimated Taxes Online. The difference between EFTPS and the IRSs other electronic payment tool Direct Pay is quite simple.

View any pending or. Estimated payments will apply to the quarter in which they are received. Make an Individual or Small Business Income Payment.

In 2021 estimated taxes are due on April 15 June 15 September 15. Select the Current Tax Year.

Tas Tax Tip Paying The Irs Tas

Irs Offers Multiple Ways To Pay

2021 Tax Changes And Tax Brackets

When Is The Form 941 Due For 2021 Due Date Irs Forms Form

Estimated Tax Payments Youtube

Faqs On Penalty For Underpayment Of Estimated Tax Https Www Irstaxapp Com Faqs On Penalty For Underpayment Of Estimated Tax Tax Tax Deductions Coding

Irs Faces Backlogs From Last Year As New Tax Season Begins Npr

Fillable Form W 2 Or Wage And Tax Statement Edit Sign Download In Pdf Pdfrun Tax Forms Internal Revenue Service Fillable Forms

Irs Covidreliefirs On Twitter Internal Revenue Service Irs Estimated Tax Payments

How To Pay The Irs Online Pay Income Taxes Pay The Irs Taxes Online By Mail Pay 1040 Online Youtube

Fastest Irs Tax Penalty Calculator For Failure To File And Pay Tax

Irs Tax Payments Arrcpa

How To Pay Your Estimated Taxes Online With The Irs Quarterly Taxes Youtube

Irs Tax Payments Arrcpa

How To Pay Federal Estimated Taxes Online To The Irs In 2022 Estimated Tax Payments Online Taxes Tax Help

Form 1040 Es Paying Estimated Taxes Jackson Hewitt

Tax Filing 2021 Performance Underscores Need For Irs To Address Persistent Challenges U S Gao